Becoming a cat claims adjuster means you’ll be on the front lines of disaster recovery, helping people get back on their feet after major events. A cat claims adjuster, short for catastrophe claims adjuster, is a professional who specializes in handling a high volume of insurance claims that arise from widespread disasters. Can you make a good living as a cat claims adjuster? Yes, experienced and licensed adjusters can earn a very good income, especially during peak disaster seasons. Who is a cat claims adjuster? They are trained professionals who assess damage, estimate repair costs, and negotiate settlements for policyholders affected by significant events.

This guide will walk you through everything you need to know to embark on this rewarding career. From the initial steps of learning about the field to becoming a licensed professional, we’ll cover the essential information to help you succeed in the world of catastrophic insurance claims.

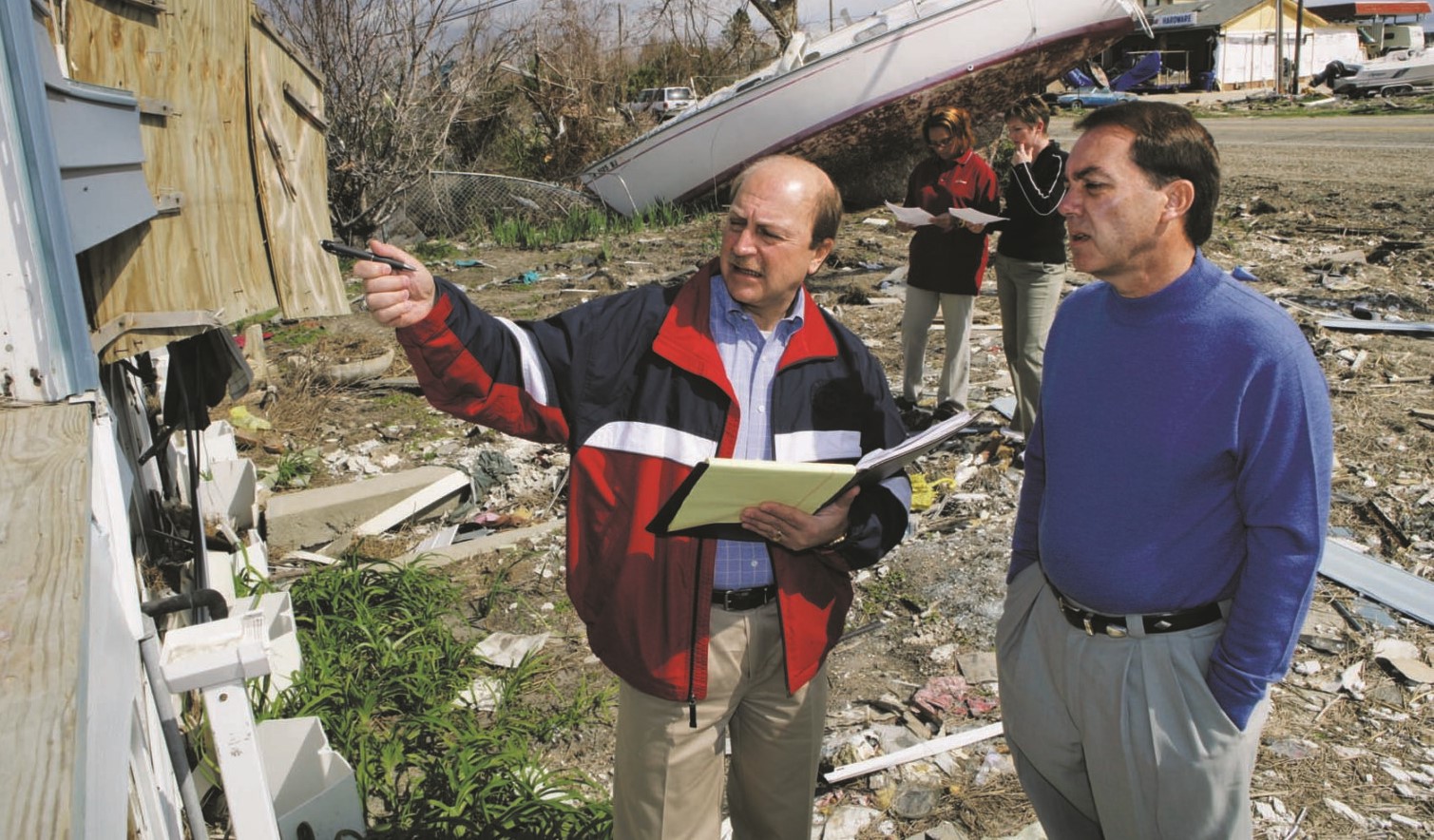

Image Source: www.nacatadj.org

What is a Cat Claims Adjuster?

At its core, a cat claims adjuster is an insurance professional who specializes in handling the aftermath of large-scale disasters. These aren’t your everyday fender-benders or leaky faucets. We’re talking about events that impact numerous policyholders simultaneously, such as hurricanes, floods, tornadoes, wildfires, and hailstorms.

When a major natural disaster strikes, the volume of insurance claims can skyrocket. This is where cat claims adjusters come in. They are deployed to affected areas to manage the influx of claims efficiently and effectively. Their role is crucial in helping individuals and businesses recover financially. They are essentially the first responders for financial recovery after a disaster.

The Role of a Cat Claims Adjuster

As a cat claims adjuster, your primary responsibility is to assess the damage to property caused by a declared catastrophe. This involves a thorough inspection of homes, businesses, and other structures. You’ll be looking at things like roof damage from high winds, water damage from flooding, or structural issues from a tornado.

Your job is to document the damage meticulously. This often involves taking photos, making detailed notes, and sketching diagrams of the affected areas. You’ll also need to estimate the cost of repairs or replacement. This requires a good understanding of construction costs, materials, and labor.

Beyond assessment and estimation, you’ll communicate with policyholders, explain their coverage, and guide them through the claims process. You’ll also negotiate with them to reach a fair settlement based on the policy terms and the damage found.

Key Responsibilities:

- Damage Assessment: Inspecting properties to determine the extent of damage.

- Documentation: Recording all findings through notes, photos, and measurements.

- Estimating: Calculating the cost of repairs or replacement.

- Policy Interpretation: Explaining coverage details to policyholders.

- Negotiation: Discussing settlements with policyholders.

- Reporting: Submitting detailed reports to the insurance company.

- Customer Service: Providing support and guidance to affected individuals.

Why Become a Cat Claims Adjuster?

The career of a cat claims adjuster offers several attractive benefits. It’s a dynamic field that keeps you on your toes, requiring problem-solving skills and a good deal of adaptability. You’ll be helping people during their most challenging times, providing a sense of purpose and contribution to the community.

The earning potential is also significant. Catastrophe adjusters, especially independent ones who work on a contract basis, can earn substantial incomes, particularly during deployment seasons. This is often paid on a per-claim basis or a daily rate, which can be quite lucrative when there’s a high volume of work.

Furthermore, it’s a career that offers flexibility. While deployments can be intense, you often have control over when and where you work, especially if you are an independent adjuster. You can choose to work solely during major disaster events or take on more routine claims during quieter periods.

Advantages of the Career:

- Meaningful Work: Helping individuals recover from disasters.

- Competitive Income: High earning potential, especially during storm seasons.

- Flexibility: Opportunities to set your own schedule and work location (as an independent adjuster).

- Dynamic Environment: Never a dull moment, with new challenges and locations.

- Skill Development: Constantly learning about construction, insurance, and problem-solving.

Steps to Becoming a Cat Claims Adjuster

Embarking on this career path involves a series of structured steps. It’s not a career you can just jump into without preparation. Proper training and licensing are essential.

Step 1: Gain Foundational Knowledge

Before you even think about licenses or training, it’s wise to get a general grasp of the insurance industry and the claims process. You don’t need a degree in insurance, but familiarizing yourself with basic concepts can be helpful.

- Insurance Basics: Learn about different types of insurance policies, particularly homeowners and commercial property policies.

- Claims Process: Understand how insurance claims are typically handled from start to finish.

Step 2: Pursue Independent Adjuster Training

This is a critical step. While some insurance companies might offer internal training, formal independent adjuster training is highly recommended, especially if you aim to be an independent adjuster. These courses are designed to equip you with the specific knowledge and skills needed for claims adjusting, including those related to catastrophic insurance claims.

Training programs typically cover:

- Insurance Policy Interpretation: How to read and understand different policy coverages.

- Damage Assessment Techniques: Methods for evaluating various types of property damage.

- Estimating Software: Familiarity with industry-standard software like Xactimate.

- Claims Handling Procedures: The correct protocols for managing claims.

- Customer Service and Ethics: How to interact with policyholders professionally and ethically.

- Report Writing: Crafting clear and concise claim reports.

Many reputable institutions offer these training programs, both online and in person. Research thoroughly to find a program that fits your learning style and budget.

Step 3: Obtain Licensing

In most U.S. states, you must hold a valid claims adjuster license to work as an adjuster. The specific requirements vary by state. Some states offer a reciprocal license, meaning if you are licensed in one state, you may be able to get licensed in others without further testing.

To become a licensed adjuster, you will generally need to:

- Meet Age and Education Requirements: Typically, you must be 18 or 21 years old and have a high school diploma or GED.

- Complete Pre-Licensing Education: Some states require specific hours of approved coursework.

- Pass a Licensing Exam: This exam tests your knowledge of insurance law, policy provisions, and claims adjusting practices.

- Submit an Application and Pay Fees: This includes a background check.

What is an adjuster license? It’s a credential issued by a state’s Department of Insurance that authorizes an individual to investigate, negotiate, and settle insurance claims on behalf of insurance companies or policyholders.

Can I become a cat claims adjuster without a license? In most states, no. A license is a legal requirement to operate as an adjuster. However, some states allow unlicensed individuals to assist licensed adjusters under direct supervision for a limited time.

Who is a licensing body? Each state has its own Department of Insurance or a similar regulatory body responsible for issuing and managing adjuster licenses.

Table 1: Common Licensing Requirements by State (Illustrative)

| State | Pre-Licensing Hours | Exam Required | Reciprocity | Background Check |

|---|---|---|---|---|

| Texas | 40 hours (PL) | Yes | Yes | Yes |

| Florida | 200 hours (PL) | Yes | Yes | Yes |

| California | Not Required (exam) | Yes | No | Yes |

| New York | 40 hours (PL) | Yes | Yes | Yes |

Note: Requirements can change. Always check the official Department of Insurance website for the most current information.

Step 4: Gain Experience and Specialize

Once you have your license, you need to gain practical experience. Many aspiring adjusters start by working for an insurance company as a staff adjuster or by partnering with an independent adjusting firm. This provides a structured environment to learn the ropes under experienced professionals.

As you gain experience, you can begin to specialize. For example, you might focus on:

- Hurricane Claims Adjuster: Handling damage caused by hurricanes, including wind, hail, and water.

- Flood Damage Adjuster: Specializing in claims related to flooding, which often have unique policy provisions.

- Hail Damage Adjuster: Focusing on claims arising from hailstorms, particularly to roofs and vehicles.

- Wind Damage Adjuster: Dealing with damage caused by high winds, such as fallen trees or structural damage.

Becoming proficient in these specializations makes you a more valuable asset, especially during major disaster events.

Step 5: Consider Professional Certifications

Beyond state licensing, several professional certifications can enhance your credibility and expertise. These certifications often involve rigorous training and examinations.

- Certified Claims Professional (CCP): A designation that signifies a high level of expertise in claims handling.

- Associate in Claims (AIC): A respected designation from The Institutes that covers various aspects of claims management.

These certifications demonstrate a commitment to professional development and can give you an edge in the job market.

The Catastrophe Claims Process

When a major disaster strikes, the process for handling catastrophic insurance claims becomes a well-orchestrated effort. As a disaster recovery adjuster, you’ll be a key player in this process.

Deployment and Mobilization

Following a widespread disaster, insurance companies will typically activate their catastrophe response teams. Independent adjusters are often contracted to help manage the surge in claims. You might be deployed to an affected area, often needing to travel and stay for an extended period.

Initial Claim Assignment and Review

You’ll receive claim assignments, usually electronically. Your first step is to review the policy details, the reported damages, and any initial information provided by the policyholder or the insurance company.

On-Site Inspection

This is a crucial phase. You’ll travel to the insured property to conduct a thorough inspection. This involves:

- Meeting the Policyholder: Introducing yourself, explaining the process, and addressing initial concerns.

- Documenting Damage: Using your training and tools to meticulously record all damage. This includes interior and exterior assessments.

- Identifying Cause of Loss: Determining if the damage is directly related to the catastrophe.

Damage Estimation and Reporting

After the inspection, you’ll use estimating software, like Xactimate, to create a detailed estimate of the repair costs. This estimate must be comprehensive and accurately reflect the scope of work needed.

Your insurance claims investigation involves more than just looking at the damage; it’s about understanding the policy and how it applies to the situation. You’ll need to justify your estimates with appropriate pricing data and documentation.

Claim Settlement and Communication

Once the estimate is finalized and approved, you’ll communicate the settlement offer to the policyholder. This involves explaining the breakdown of the settlement, any deductibles, and what the policy covers.

Negotiation might be necessary if the policyholder disagrees with the estimate. Your goal is to reach a fair and equitable settlement that aligns with the policy terms and the documented damages.

Finalizing the Claim

After a settlement is agreed upon, you’ll ensure all necessary paperwork is completed and submitted to finalize the claim. This might involve issuing payments or authorizing repairs.

Skills and Qualities of a Successful Cat Claims Adjuster

Beyond technical knowledge and licensing, certain personal attributes are vital for success in this demanding field.

Essential Skills:

- Attention to Detail: Crucial for accurate damage assessment and estimation.

- Problem-Solving: The ability to analyze situations and find effective solutions.

- Communication: Clear, concise, and empathetic communication with policyholders and stakeholders.

- Time Management: Juggling multiple claims and deadlines, especially during a catastrophe.

- Negotiation Skills: Reaching fair agreements with policyholders.

- Technical Aptitude: Proficiency with estimating software and other relevant technology.

- Adaptability: Being able to work in challenging environments and adapt to changing circumstances.

Desirable Qualities:

- Empathy: Showing compassion and understanding towards people experiencing loss.

- Integrity: Conducting yourself ethically and honestly.

- Resilience: The ability to handle stress and demanding work conditions.

- Self-Discipline: Especially important for independent adjusters who manage their own schedules.

- Physical Stamina: The job often involves significant walking, climbing, and working outdoors.

Working as an Independent Adjuster

Many cat claims adjusters choose to work as independent adjusters rather than for a single insurance company. This offers more flexibility and potential for higher earnings, but it also comes with its own set of challenges.

Benefits of Being Independent:

- Variety of Work: You can work for multiple insurance companies, handling a diverse range of claims.

- Higher Earning Potential: You are often paid per claim, allowing you to earn more during busy periods.

- Flexibility and Autonomy: You can choose where and when you work, especially outside of catastrophe deployments.

- Be Your Own Boss: For many, the independence is a major draw.

Challenges of Being Independent:

- Inconsistent Work: Income can fluctuate significantly depending on disaster activity.

- Need for Self-Marketing: You need to actively seek out work opportunities with adjusting firms or insurance companies.

- Responsibility for Expenses: You are typically responsible for your own travel, vehicle, and office expenses.

- Constant Learning: You must stay updated on industry changes, regulations, and new technologies.

To succeed as an independent adjuster, you’ll need to build relationships with independent adjusting firms and insurance carriers. Networking and demonstrating your reliability and skill are key.

Navigating Different Disaster Types

As a disaster recovery adjuster, you’ll encounter a wide array of damages. Each type of disaster requires specific knowledge and approaches.

Hurricane Claims Adjuster

Hurricanes bring a combination of threats: high winds, heavy rain, and storm surge.

* Wind Damage: Roof damage (shingles blown off, structural damage), siding damage, damage from flying debris.

* Water Damage: Interior flooding from rain, wind-driven rain through openings, and coastal flooding.

* Hail Damage: Often accompanies hurricanes or associated thunderstorms.

Flood Damage Adjuster

Flood damage is unique because it’s typically governed by separate flood insurance policies (often through the National Flood Insurance Program – NFIP) rather than standard homeowners policies.

* Water Intrusion: Rising water levels that inundate the structure.

* Mud and Debris: Sediment and debris left behind after floodwaters recede.

* Mold and Mildew: Potential issues due to prolonged dampness.

Hail Damage Adjuster

Hailstorms can cause significant damage to roofs, siding, windows, and vehicles.

* Roof Damage: Dents, punctures, and granule loss from impacts.

* Siding Damage: Cracks, dents, and holes in exterior walls.

* Window Damage: Cracked or broken glass.

Wind Damage Adjuster

Beyond hurricanes, straight-line winds from thunderstorms or tornadoes can also cause substantial damage.

* Structural Damage: Roof lifting, wall collapse.

* Debris Impact: Damage caused by trees, signs, or other objects blown by the wind.

* Water Intrusion: Resulting from wind damage to the building envelope.

As a property claims specialist, your ability to accurately identify and estimate these different types of damages is paramount.

Tools of the Trade

Modern claims adjusting relies on a suite of specialized tools and technologies to ensure accuracy and efficiency.

- Estimating Software:

- Xactimate: The industry standard for creating detailed repair estimates. It uses a comprehensive database of pricing for labor, materials, and equipment across different geographic regions.

- Measurement Tools:

- Laser Measurers: For quickly and accurately measuring distances and dimensions.

- Tape Measures: Still essential for detailed measurements.

- Drones: Increasingly used for inspecting hard-to-reach areas like roofs, providing high-resolution imagery and allowing for safer assessments.

- Photography Equipment:

- Smartphones/Tablets: Modern smartphones have excellent cameras, essential for documenting damage.

- Digital Cameras: For higher resolution or specific photographic needs.

- Reporting Software:

- Claim Management Systems: Software used by insurance companies and adjusting firms to manage claims data, assign tasks, and track progress.

- Personal Protective Equipment (PPE):

- Hard Hats, Safety Vests, Sturdy Footwear: For safety during property inspections, especially in hazardous conditions.

Building Your Career as a Cat Claims Adjuster

Becoming a successful cat claims adjuster is a journey that requires continuous learning and adaptation.

Continuous Learning and Development

The insurance industry is constantly evolving. New building materials, construction techniques, and regulatory changes mean you must commit to ongoing education.

* Attend Seminars and Webinars: Stay current with industry trends and best practices.

* Pursue Advanced Certifications: Further professional development can open doors to more opportunities.

* Read Industry Publications: Keep up with news and insights relevant to claims adjusting.

Networking and Building Relationships

In the disaster recovery adjuster world, connections are vital.

* Join Professional Organizations: Associations like the National Association of Public Insurance Adjusters (NAPIA) or state-specific adjuster associations offer networking opportunities and resources.

* Connect with Adjusting Firms: Build relationships with firms that hire independent adjusters for catastrophe deployments.

* Maintain Good Relationships with Insurers: A reputation for professionalism and accuracy will lead to more assignments.

Ethical Considerations

Ethical conduct is paramount for any property claims specialist.

* Honesty and Transparency: Always deal truthfully with policyholders and your employers.

* Fairness: Ensure your assessments and settlements are fair and consistent with policy terms.

* Confidentiality: Protect sensitive information related to claims and policyholders.

Frequently Asked Questions (FAQ)

Q1: How long does it take to become a cat claims adjuster?

A1: The timeline can vary. Generally, it takes a few months to complete independent adjuster training and obtain state licensing. Gaining significant experience, especially in catastrophe claims, can take longer, often a year or more.

Q2: What is the average salary for a cat claims adjuster?

A2: Salaries vary widely based on experience, location, type of employment (staff vs. independent), and the frequency of catastrophic events. Independent adjusters can earn anywhere from $60,000 to over $150,000 per year, with the potential for much higher earnings during busy catastrophe seasons.

Q3: Do I need a college degree?

A3: While a college degree is not always mandatory for licensing, it can be beneficial for career advancement and for securing positions with larger insurance companies. Many adjusters have degrees in business, finance, or related fields.

Q4: What are the best states for cat claims adjusters?

A4: States prone to frequent natural disasters, such as Florida, Texas, Louisiana, California, and those in the Midwest (for tornadoes and hail), often have a higher demand for catastrophe adjusters.

Q5: Is the job stressful?

A5: Yes, the job can be very stressful, especially during major catastrophes. You’ll work long hours, deal with people in distress, and face demanding deadlines. Resilience and strong stress management skills are essential.

Q6: How does a flood damage adjuster differ from a general property claims adjuster?

A6: A flood damage adjuster often specializes in claims covered by specific flood insurance policies, which have unique regulations and claim forms (like NFIP forms). They need specialized knowledge about flood damage assessment and mitigation, which differs from standard wind or fire damage.

Q7: What is the role of a property claims specialist?

A7: A property claims specialist is a broad term for someone who handles claims related to damaged property. This can include everything from a minor home repair to a large commercial building loss. A cat claims adjuster is a specialized type of property claims specialist who focuses on large-scale, widespread events.

Becoming a cat claims adjuster is a challenging yet incredibly rewarding career path. By following these steps, acquiring the necessary training and licenses, and developing the right skills, you can position yourself for success in this vital field, helping communities rebuild and recover from disaster.